Investing in commercial real estate can unlock long-term financial growth, tax advantages, and steady income, but only when the deal is legally sound and risk-free. Too often, investors dive into transactions without the right legal guidance and face avoidable losses due to unclear agreements, zoning conflicts, or hidden liabilities.

This is where working with a commercial real estate lawyer becomes not just helpful, but essential.

Whether you’re purchasing a retail unit, leasing an office building, or developing an industrial warehouse, legal complexities are everywhere. From contract clauses to municipal regulations, a lawyer’s role is to protect your interests and future-proof your investment.

Let’s explore how they do that, and why smart investors never go into a deal without one.

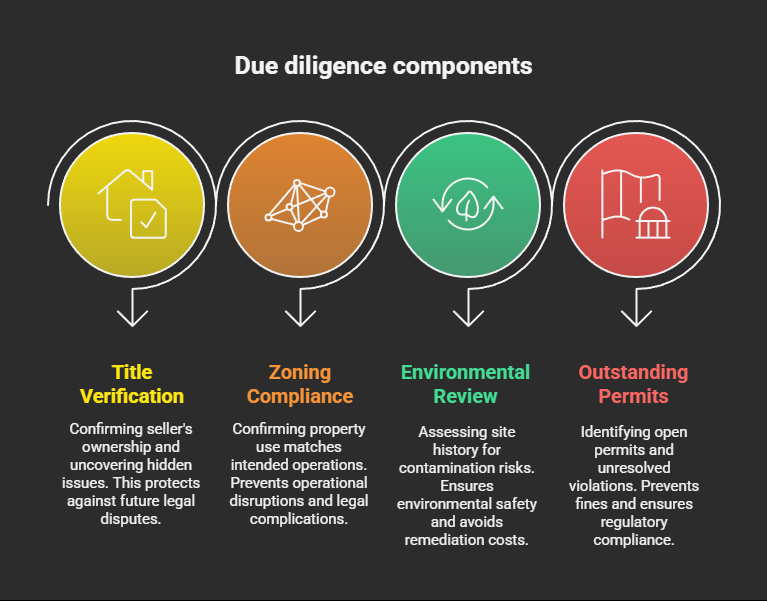

1. Due Diligence That Goes Beyond Google

Before signing anything, your lawyer will conduct deep due diligence, much deeper than what most investors can do on their own.

What This Involves:

- Title Verification: Ensuring that the seller has full ownership and there are no hidden liens, easements, or encumbrances.

- Zoning Compliance: Verifying that the property use aligns with your intended operations, be it retail, industrial, or mixed-use.

- Environmental Review: Reviewing past site usage and any environmental assessments for contamination risks.

- Outstanding Permits or Violations: Flagging any open permits, non-compliant construction, or unresolved fines.

Mini-Case Insight:

An investor once bought a warehouse property for a logistics startup. Post-purchase, they discovered the site was zoned as “residential buffer,” limiting truck movement and storage. A real estate lawyer would’ve flagged this before closing, saving the buyer from a costly mistake.

2. Ironclad Contracts That Actually Protect You

Commercial real estate contracts are dense. One vague sentence or missed clause can leave you paying for things you didn’t agree to, or worse, tied into obligations for years.

How Your Lawyer Helps:

- Reviews purchase and sale agreements.

- Identifies problematic contingencies and vague wording.

- Negotiates terms such as closing timelines, deposit protections, or tenant liabilities.

- Adds protective clauses like “subject to financing” or “subject to clean environmental report.”

Your lawyer speaks the language of law and business, turning dense contracts into clear terms that protect your money.

3. Navigating Lease Agreements With Long-Term Impact

If you’re leasing the commercial property, your lease agreement is just as important as a purchase contract. Leases often span 5–15 years and come with obligations that can make or break your ROI.

Your Lawyer Will:

- Ensure clauses around maintenance, rent escalations, termination, and subleasing work in your favor.

- Limit exposure to surprise costs like property taxes or structural repairs.

- Create options for renewal or early exit, so you’re not trapped.

Investor Tip:

Many leases include “triple net” clauses, passing on property taxes, insurance, and maintenance to the tenant. A lawyer ensures these costs are clear and negotiable upfront.

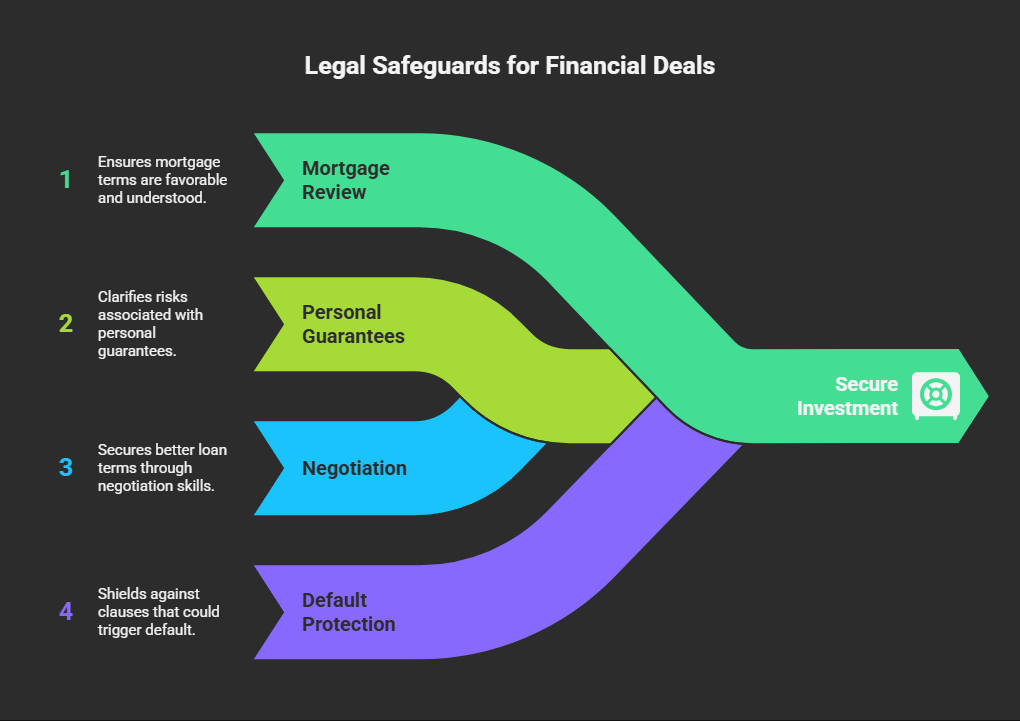

4. Managing Complex Financing and Lending Terms

Most commercial deals are financed. Lenders often include detailed legal conditions in their loan agreements, which, if misunderstood, can put your entire investment at risk.

Your Lawyer Can:

- Review mortgage documentation.

- Explain personal guarantees and risk exposure.

- Negotiate better terms with lenders.

- Protect you against default-triggering clauses.

5. Property Development and Permit Assistance

Buying land or remodeling existing property? This means navigating a whole new layer of complexity, permits, approvals, and construction law.

How Legal Guidance Helps:

- Ensure your development plan fits local building codes and zoning bylaws.

- Handle land-use applications, variances, and rezoning requests.

- Draft and review construction contracts.

- Advise on risk allocation between builder and investor.

Pro Insight:

If your contractor delays the project beyond deadline, does the contract allow for penalties? A lawyer can include protective “liquidated damages” clauses to keep timelines on track.

6. Tax & Ownership Structuring Support

Choosing the right legal structure for your property can reduce taxes and personal liability.

What Your Lawyer Coordinates With Tax Advisors:

- Whether to buy as an individual, corporation, partnership, or trust.

- Implications of GST/HST on the purchase.

- Strategies to reduce capital gains or land transfer tax.

- Estate planning for generational property transfers.

Proper structuring today can save tens of thousands tomorrow.

7. Dispute Prevention & Legal Representation

Disputes in commercial real estate are often costly. Prevention is better than resolution, and lawyers help with both.

Prevention:

- Draft clear, enforceable agreements.

- Reduce risk through warranties, disclosures, and representations.

If Things Go South:

- Represent you in mediation or court.

- Defend against zoning appeals, contract breaches, or boundary disputes.

- Handle eviction or enforcement issues for tenant-occupied investments.

Frequently Asked Questions

Do I need a commercial real estate lawyer for small deals?

Even smaller investments involve complex contracts and legal risks. A lawyer ensures you’re not stepping into a financial trap.

How early should I involve a lawyer?

Ideally, before signing a Letter of Intent (LOI). Early legal advice can reshape the entire deal in your favor.

What’s the cost of hiring one?

Many offer fixed-fee services for common transactions or hourly rates for ongoing work. In the context of a high-value deal, the legal fee is a small price for protecting your capital.

Final Thoughts

A commercial real estate transaction has numerous layers of complexity, some of them expected and many of them not. Putting all your money in the hands of your broker or letting your feelings drive you is another bet. Rather, hire a commercial real estate attorney that knows the lay of the land and how to preserve your investment.

With the skills of a competent legal advisor, you can make a risky deal a rollicking investment. Contracts end up being protective tools. Due diligence gets to be insightful And where you spend a dollar, there the dollar moves without hesitation.

When purchasing, repairing, constructing, or developing a building, rent going, rent taking, or buying real property in any way, form or stuff: don’t get just a lawyer. Get peace of mind.

Ready to Secure Your Next Investment?

Book a 15-Minute Consultation With a Commercial Real Estate Lawyer

Protect your capital, close with confidence, and build a secure portfolio.